NEW YORK—While increased eyeglass sales have helped independents maintain their market share over the past four years, conventional optical chains have lost 3.3 share points since the recession started, according to a recent VisionWatch report released during Vision Expo East by The Vision Council's senior director of industry research, Steve Kodey. However, as the economy slowly and steadily recovers, the conventional chains are seeing more foot traffic in the malls and shopping centers that are helping their sales volumes, said the report, an excerpt of which follows:

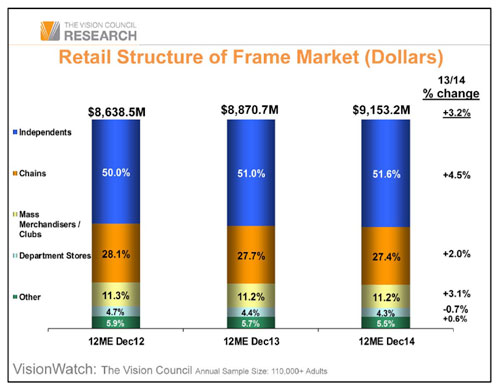

The 71.5 million pairs of frames sold in the U.S. during the 12-month period ending December 31, 2014, generated more than $9.15 billion in sales revenue, a 3.2 percent increase when compared to dollar value generated one year earlier.

Most of the recent increase in unit sales activity occurred in the last six months of 2014 (+3.7 percent) rather than the first half of 2014 (+0.7 percent). Increases in dollar revenue followed a similar pattern as frame prices also increased more in the last half of 2014 than in the first half of the year.

Independent retail outlets have been able to keep up a consistent level of eyeglass frame sales and grow their market share as a group. Sales of frames via independent ECP retailers were up by 3.3 percent in terms of units over the past 12 months, and they were up 4.5 percent in terms of dollars thanks to slightly rising prices (+$1.67 per pair during the 12-month period ending December 2014).

Increased eyeglass purchases by consumers with managed vision care benefits since the start of the recession has helped the independents keep the overall eyeglass market strong over the past four years. Independent ECPs have been able to grow their share of the frame market dollar pie by 6.5 share points since the 12-month period ending December 2007.

Over the past year, frame purchases from independent ECPs have increased most among eyeglass users over the age of 55, people from higher‐income households, adults from the MP region of the country and eyeglass buyers from higher income households.

Optical Chains Lose 3.3 Share Points

The dollar share gains from eyeglass frame sales for independent ECPs have come mostly at the expense of the conventional optical chains that have lost 3.3 share points over the past five years since the recession started. Fortunately, for conventional chains, the decline in sales turned a corner in late 2011 and has grown slowly over the past couple of years—despite losing share to the independent ECPs and online retailers. For the 12-month period ending December 2014, dollar value from frame sales increased by 2.0 percent in value over the past year and unit sales increased by 1.1 percent during this same period of time.

In fact, as the economy slowly and steadily recovers, the conventional chains are seeing more foot traffic in the malls and shopping centers that are helping their sales volumes. Over the past year, conventional chain eyeglass frame sales are up most for men, adults over the age of 45, people from higher‐income households, people from the MP region of the country—with frames priced at more than $150 per pair seeing the most growth among chain retailers.

Mass merchandisers and wholesale clubs have also lost some aggregate sales revenue because of the poor economy; however, they have not suffered as much as the conventional chains and their recovery over the past few years has been stronger than the rebound experienced by department store and conventional chain optical retailers.

Over the past year, dollar sales of ophthalmic frames among mass merchants and wholesale clubs increased by 3.1 percent and unit sales increased by 2.4 percent. Over the past year, frame purchases among mass/club retailers increased most among women, Americans over the age of 55 years old, and Americans from lower‐income households.

The slightly rising average sale prices during the 12-month period ending December 2014 (+$0.60 per pair), is primarily attributable to growing sales of frames priced at more than $150 per pair for mass merchant/wholesale club retailers particularly among club retailers like Costco, BJs and Sam's Club.

Source: International Vision Expo East Statistics Committee Presentation 2015/VisionWatch, the large scale continuous research study conducted by The Vision Council with approximately 110,000 respondents. Mass Merchandisers are made up of Walmart, Target, and optical departments in other mass merchandisers (such as Shopko) as well as wholesale clubs such as Costco, Sam's, BJ's, and other (smaller) wholesale club retailers. Department Stores are made up of Sears, JC Penney, Macy's, and a very few locations in other department store retailers. Conventional Chains are made up of 55 chains with more than ten locations that are not a mass merchandiser, wholesale club, or department store.